While so much of personal finance is common sense – don’t spend more than you make, don’t buy a house you can’t afford, start to invest money while you’re young

While the name may be amusing the reality of zombie debt is anything but funny. Zombie debt is old debt that has been written off years ago, only to be sold to

Giving money to philanthropic causes is important to many of us. Year end giving in particular is popular with both donors and charitable organizations. The

It seems like we’ve been conditioned to shop since birth. While an occasional splurge is nothing to get worked up about, we’ve become incredibly wasteful in

Here are the answers to some of the most frequently asked financial questions.

I’ve just started my first job. Do I really have to start saving for

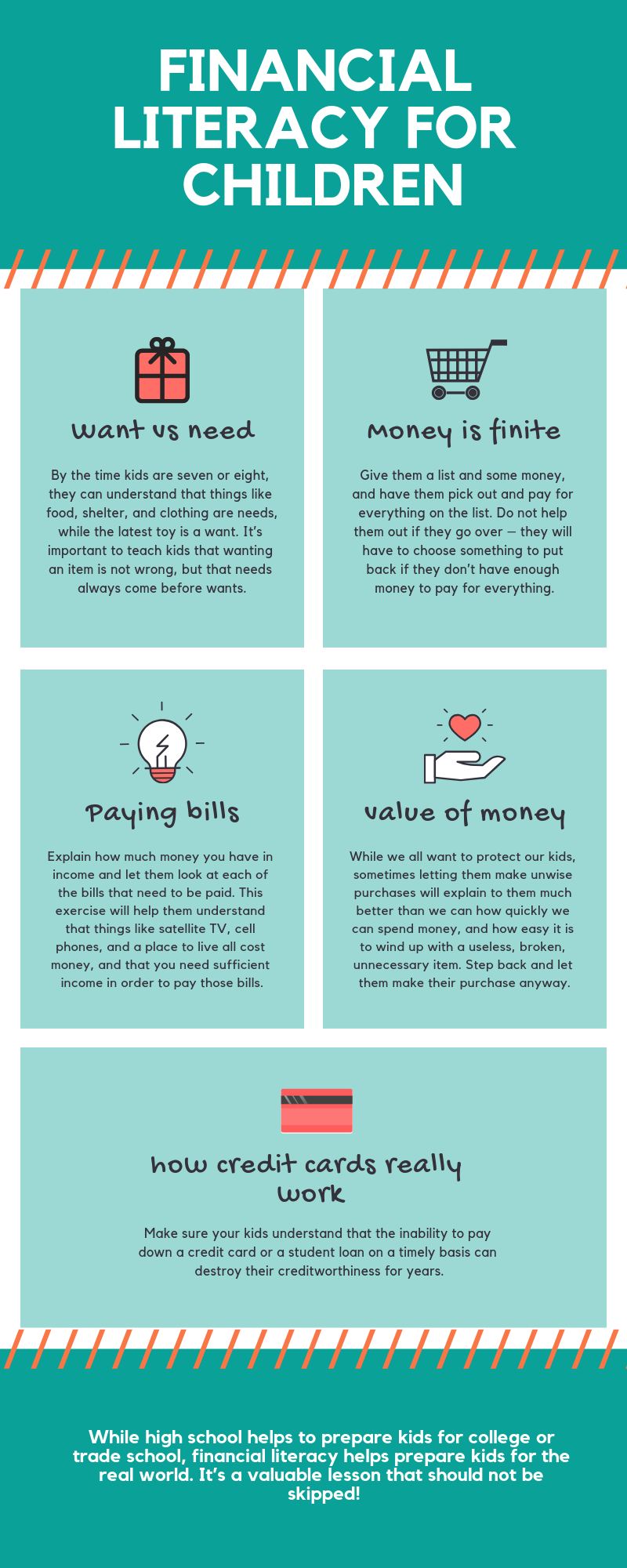

In a recent survey by JumpStart Coalition for Financial Literacy, only 26 percent of those between the ages of 13-21 said that they had been taught how to

While never an easy decision, filing bankruptcy can provide immediate assistance to those struggling to pay their debts. A long, sometimes complicated process

If you’re currently in the market for a home, it will speed up the process considerably if you’re familiar with the various mortgage options available. Finding

Whether you’re earning a six-figure salary or just out of college, creating and maintaining a budget is a must. Having a budget that you actually use can help

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal

Has a dog or cat grabbed hold of your heart? It doesn’t take much. A paw on the arm. A lick on the nose, or a soft purr or whimper can turn most of us into dog